Hand-wringing now extends to Spain and Portugal. If sovereign debt itself were the core problem, Japan would have imploded decades ago. High sovereign debt is generally a self-solving problem so long as national economies continue on a reasonable growth trajectory (e.g., Japan, to-date). Therefore, the real issue is investor expectations regarding Europe's future growth.

Why are investors concerned?

Because demographics is destiny.

******************************************************

UPDATE: You can download the tool used to prepare charts in this post. The tool is stored on Docstoc, download it here. Zero Excel skills are needed. The tool is operated only with a mouse. Use it with Excel2007 or Excel2010. Do not attempt use with Excel2003. There's also a brief, illustrated walkthrough, a PDF document which can be downloaded here.

******************************************************

Using historic and projected population data from the UN, we begin with a look at world population trends between 1950 and 2050.

Click image to see full size

The UN data covers 196 countries. Between now and 2050, the UN Population Division projects that:* Average life expectancy will increase 10%, from 69 to 76 years

* Global population will increase one-third, from 7.0 to 9.5 billion people

* Median age will increase one-third, from 29 to 39 years

* Fertility will fall 20%, 2.5 to 2.0 births per woman

* The ratio of persons aged 15-64 years old to total population, the broadly-defined productive population ratio, will fall from 64% to 61%.

Except for exacerbation of climate change caused by a one-third increase in human population and continued, out-sized growth in the global middle-class, this global picture is fairly benign. It should be noted that increasing life expectancy, not birth rate, now drives population growth. Current macro-economic concerns are driven by how the global picture breaks down between regions and countries.

Asia, North America and Latin America do not materially deviate from global averages. However, comparison between Africa and Europe helps to define Europe's emerging demographic crisis. Europe and Africa have been headed in opposite demographic directions for decades. We begin with Africa:

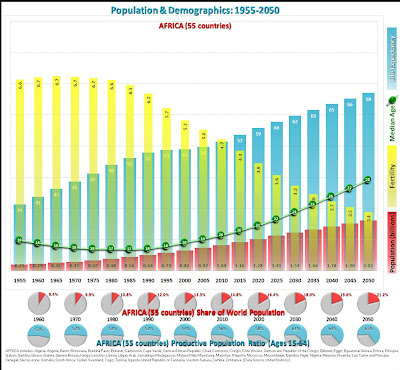

Click image to see full size

Africa forecast:* Average life expectancy will increase 21%, from 56 to 68 years

* Population will double, from 1.0 to 2.0 billion people (in only two generations!)

* Median age will increase 45%, from 20 to 29 years

* Fertility will fall by half, from 4.7 to 2.4 births per woman

* The productive population ratio will leap from 56% to 65%.

Developed economies have enjoyed productive population ratios that cluster around 65% since 1950. Japan had the highest ratio in 1970 (69%) and peaked 20 years later at 70%. Japan's productive population ratio is now 64%. The U.S. is a model of consistency, compared to other nations. Our ratio remains in a fairly tight 61% to 67% range over 1950-2050.

History suggests that the productive population ratio dividing line between growing vs. stagnant economies is about 60%. The Africa forecast suggests that with establishment of genuine governance and rule of law, Africa's improving demographics could finally propel it out of poverty.

We now look at Europe:

Click image to see full size

Europe forecast:* Average life expectancy will increase 8%, from 76 to 82 years

* Population remains stuck at 760 million

* Median age will increase 18%, from 40 to 47 years

* Fertility will rise, from 1.5 to 1.8 births per woman

* The productive population ratio will drop from 66% to 53%.

In 1950, Europe accounted for 20% of global population while Africa comprised 8%. By 2050, these positions will be reversed. Europe's fertility has been below replacement rate since 1980 and is forecast to remain below replacement rate up to 2050. Europe's current life expectancy exceeds Africa's forecast improvement, 40 years hence, by 10%.

Europe faces an epic demographic crisis. Its productive population ratio is forecast to fall one-fifth over the next 40 years. With the exception of the UK, European countries lack immigration policies rooted in demographic reality. By retaining the Pound instead of adopting the Euro the UK effectively monetized its (comparatively) progressive immigration policy. Brilliant!

Let's look at where the European demographic forecast is most adverse, the 12 countries in UN's definition of "Southern Europe":

Click image to see full size

Southern Europe forecast:* Average life expectancy will increase 5%, from 80 to 84 years

* Population will slightly increase, to 170 million

* Median age will increase 20%, from 41 to 49 years

* Fertility will rise, from 1.4 to 1.8 births per woman

* The productive population ratio will plummet, from 64% to 49% (a 23% decline in ratio)

Compared European averages, Southern Europe is already older, living longer, with lower birth rate and proportionately less productive population. The forecast calls for these demographic differences to get worse. Southern Europe includes Greece, Portugal and Spain. The region also includes Italy, whose demographic crisis has sparked fertility incentives from a few local governments. Southern Europe's productive population ratio is forecast to fall by almost one-quarter.

Why will a steep drop in productive population ratio kill growth in developed nations? Won't technological advances improve productivity in the remaining workforce? While the answer to the 2nd question is "most likely" the answer to the first is "because you must also consider life expectancy". The short answer to the first question is "because taxes will rise".

The flip-side of Southern Europe's 23% fall in productive population ratio is that the unproductive population ratio will jump 42%. Compare this to Africa, where the unproductive population ratio will decline by 20%. In a macroeconomic context, demographics is truly a two-edged sword. European governments, particularly in Southern Europe, will raise taxes in future to support an exploding old-age population. An average life expectancy of 84 translates to a minimum of 20 unproductive years for each healthy person.

By missing the bigger issue the media has also missed the most likely next big debt crisis. The only developed country in worse demographic shape than Europe is the 2nd largest economy on the planet. Japan's productive population ratio is forecast to fall to 51% by 2050 as its already-stellar life expectancy climbs to 87 years. Deflation already casts a pall over expectations for the Japanese economy.

This analysis also explains why a seeming turnaround in attitude regarding the dollar is really no surprise. The U.S. will get older, its productive population ratio will fall and taxes will rise but the real issue is the relative magnitude of these trends. Total U.S. population will increase one-third over the next 40 years and the productive population ratio will remain above 60%. It turns out that being a nation of immigrants is both a moral cause and a saving grace.

(All analysis by TheRaven).

+breed+danger+6x8.jpg)

+5x7.jpg)

No comments:

Post a Comment