Click image to view full-size

While the chart is loaded with legal terms and appears to be authoritative, its provenance depends on authorship. If the author is a financial meltdown enthusiast of some sort, the chart could be dismissed as a narrow-focus example, an exaggeration, or perhaps just plain wrong. The chart follows the paths taken by just one mortgage (the author's), through our securitization maze.

We're learning in real-time about a consumer debt system that ran amok. Have a look at this example of ridiculously reckless development, before we examine the author's bona fides.

Dan Edstrom's chart isn't the product of a hobbyist, although more than a few banks must wish that it was. Dan is a Securitization Auditor. Not only does he analyze mortgage transactions in a professional capacity, he also lectures at securitization seminars given to attorneys. Why do attorneys pay $500 to attend his one-day seminars? The HuffPo article and a related post on the Zero Hedge financial blog, mention only that Dan is employed by DTC Systems.

Dan's bio presents a strong claim to mortgage securitization expertise: President of DTC Systems, Inc, having been in Information Technology for the last 18 years as a Systems Architect and Software Architect. The transformation of complex business requirements to complex Wall Street Engineering was an easy one. Securitization Expert, Daniel Edstrom analyzes complex financial engineering securitization transactions as well as providing a failure analysis, with well over 4,000 hours of research into Securitization. Besides working for his own company, Daniel is a Senior Securitization Analyst for Luminaq.

If this post hasn't been sufficiently alarming, consider that Dan needed a year to chart the myriad transactions associated with his own mortgage! After such effort, by a mortgage securitization expert who knows all the institutions, transaction paths and players, the mortgage disaster is easier to understand and more reprehensible than we knew.

Dan's explains all to CNBC, here.

Chart: Huffington Post

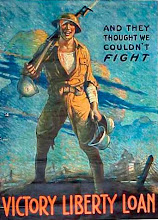

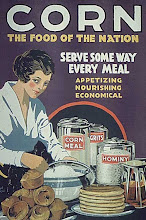

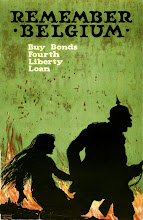

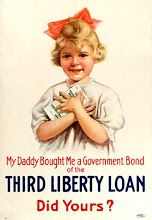

Pictures: Huffington Post

Captions: TheRaven

+breed+danger+6x8.jpg)

+5x7.jpg)

See, this is how a broke, property-less person consoles herself. . . .

ReplyDelete